Contributions 2026: rates and caps applicable

For 2026, the change is as follows:

-

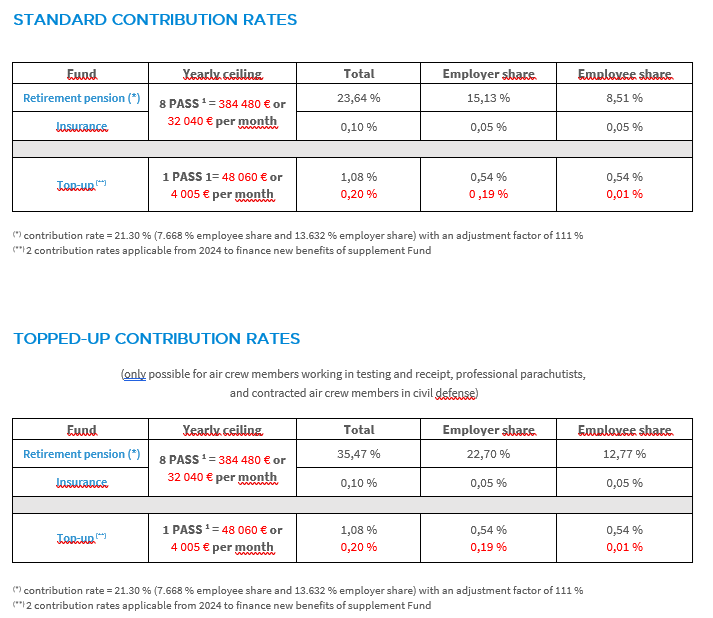

- The Social Security cap used to calculate the contributions of the various funds increases to €4,005 per month and €48,060 per year (x8 for the pension and insurance and x1 for the supplementary fund).

- The second contribution rate to the top-up fund, which is falling from 0.40% to 0.20%.

The others contribution rates applicable in 2025 will be maintained for 2026.

Please take account of these new parameters, applicable from the pay of January 2026.