Looking to estimate your future entitlements?

(If you are claiming through the alternating work-retirement program, a separate forecasting tool is available through your personal account).

Below is the tutorial CRPN has put together to help you get the most out of our pension estimator.

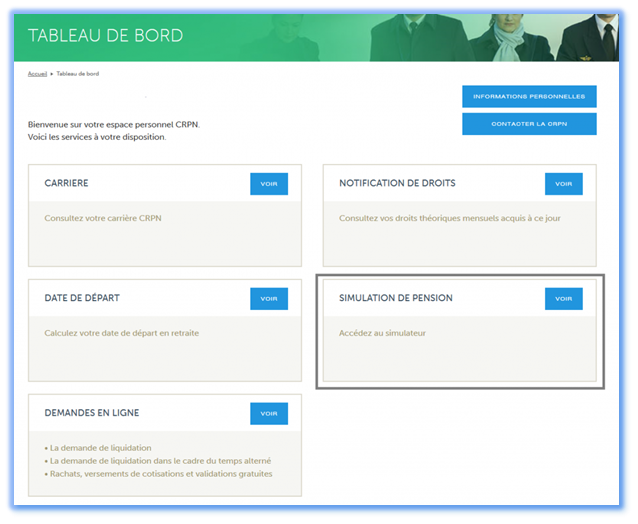

Just log in to your personal account, go to the dashboard, and click on Forecast your pension.

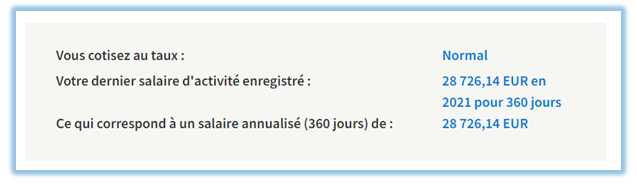

When you start the estimator, it will automatically display your contribution type(standard or increased) and the last salary that has been posted to your account, scaled to 360 days.

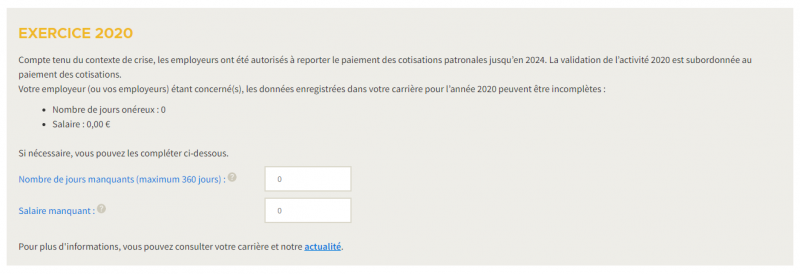

EXERCICE 2020

If your employer used the deferred contribution payment facility following the Covid-19 crisis, you can perform a simulation of the missing 2020 times and salaries in your career record in the dedicated section:

To reconstitute your missing 2020 salary in your career record, you must add together the salaries subject to CRPN contribution of all payslips for the year 2020 for the employers concerned.

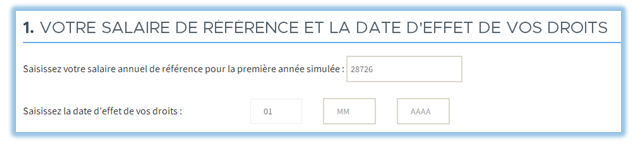

STEP 1

This salary is also used by default (see below) for the years being forecasted. However, you can also choose to replace this default value with the salary value of your choice.

In step 1, you will also need to enter the date on which you intend to begin drawing your pension (“your pension effective date”).

STEP 2

In step 2, you will need to detail out your expected career, beginning with the first year that has not yet been posted to your CRPN career account up to your chosen date of full retirement.

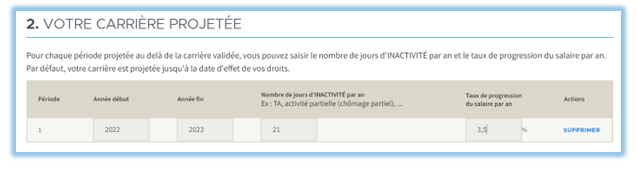

If you expect all of the periods you are adding for your forecast to be identical in days of activity and in salary progression, just enter one “Period” beginning in 2019 and continuing up to your year of full retirement (see picture A below).

Picture A

Otherwise:

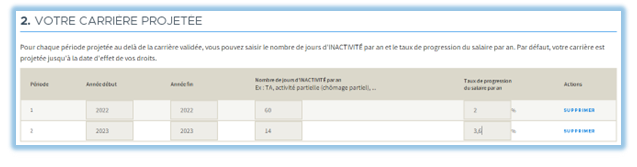

- If your number of days off work per year,

- Or if your expected rate of salary increase/decrease,

differs from one year to the next, you will need to add one or more periods by clicking on “+add a period” in order to enter your expected career in as much detail as you can (see picture B below).

Picture B

The box for “Number of days OFF WORK per year”

If you won’t have any days off work during the period being forecast, just leave the box for “Number of days OFF WORK per year” blank.

If you will have days off work during the forecasted period, you will need to enter your number of days off work per year (e.g. days off through the alternating work-retirement program, due to partial employment, etc.).

The box for “Yearly rate of salary increase/decrease”

You can enter a percentage by which you expect your salary to go up or down (if you expect a decrease in salary, put a minus sign in front of this percentage).

STEP 3

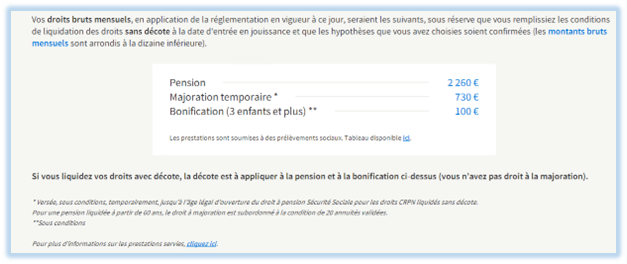

Click on the “Estimate your future pension” button. This will display the gross notional amounts of your pension, top-up, and bonus.

You will need to meet all eligibility requirements before you can draw your entitlements. To learn more, please refer to our page “Understanding my retirement pension”.

You can perform as many forecasts as you want, your forecast history will be available when you log in to your personal account.